34+ Ultra High Net Worth Legacy Plan

Web When your net worth reaches 30M to 50M translating to in the real world having enough capital to sustain your family without the need to work. Web The estates of ultra-high-net-worth individuals and families those with assets of 30 million or more can be inherently complex so having a comprehensive estate plan is.

Anatomy Of The Rich Who They Are How They Got There What They Own Institutional Real Estate Inc

Such families often face challenges in managing this level of wealth and as their net worth.

. Disclaimer By clicking I AGREE below you are confirming that you are a. Web In the interest of attracting UHNWIsthose with 30 million or more in net worthlegacy planning plays a key role in developing long-term goals finding ways to. Web But it can be done.

Ultra-high net worth UHNW individuals family offices and private banks are becoming increasingly frustrated by the. With a reasonable amount of planning a lot of disciplined hard work calculated risk taking and a bit of luck becoming wealthy is a real possibility. Web 6 Types of Permanent Life Insurance Policies to Accomplish High Net Worth Estate Planning Goals 1.

Web Legacy portfolio management techniques are flawed. Web Why Legacy Planning is Important to High-Net-Worth Families Aura Group. Web Ultra High Net Worth An ultra-high-net-worth individual is normally somebody with a minimum of 30 million in cash or assets that can easily be transformed into cash.

Now losing 67k is no picnic. For ultra-high-net-worth families making gifts today at the depressed market prices is an opportunity to. Web An Ultra High Net Worth family has accrued a liquid net worth of over 30 million.

Freeze lower value of assets for gifting purposes. To be classified as ultra-high net worth you need at least 30 million available to invest. You can make it.

Through this process and the plan we create together. Purposeful Wealth Management Contents 01 Dear reader 02 Our approach 04. While still trailing behind Europe and North.

Web An ultra high net worth investor who had 75 million will lose 25 million. Web As Ultra High Net Worth financial advisors and as UHNW investors ourselves we understand that with greater wealth comes greater financial complexity. Web Very high net worth clients have at least 5 million in liquid assets.

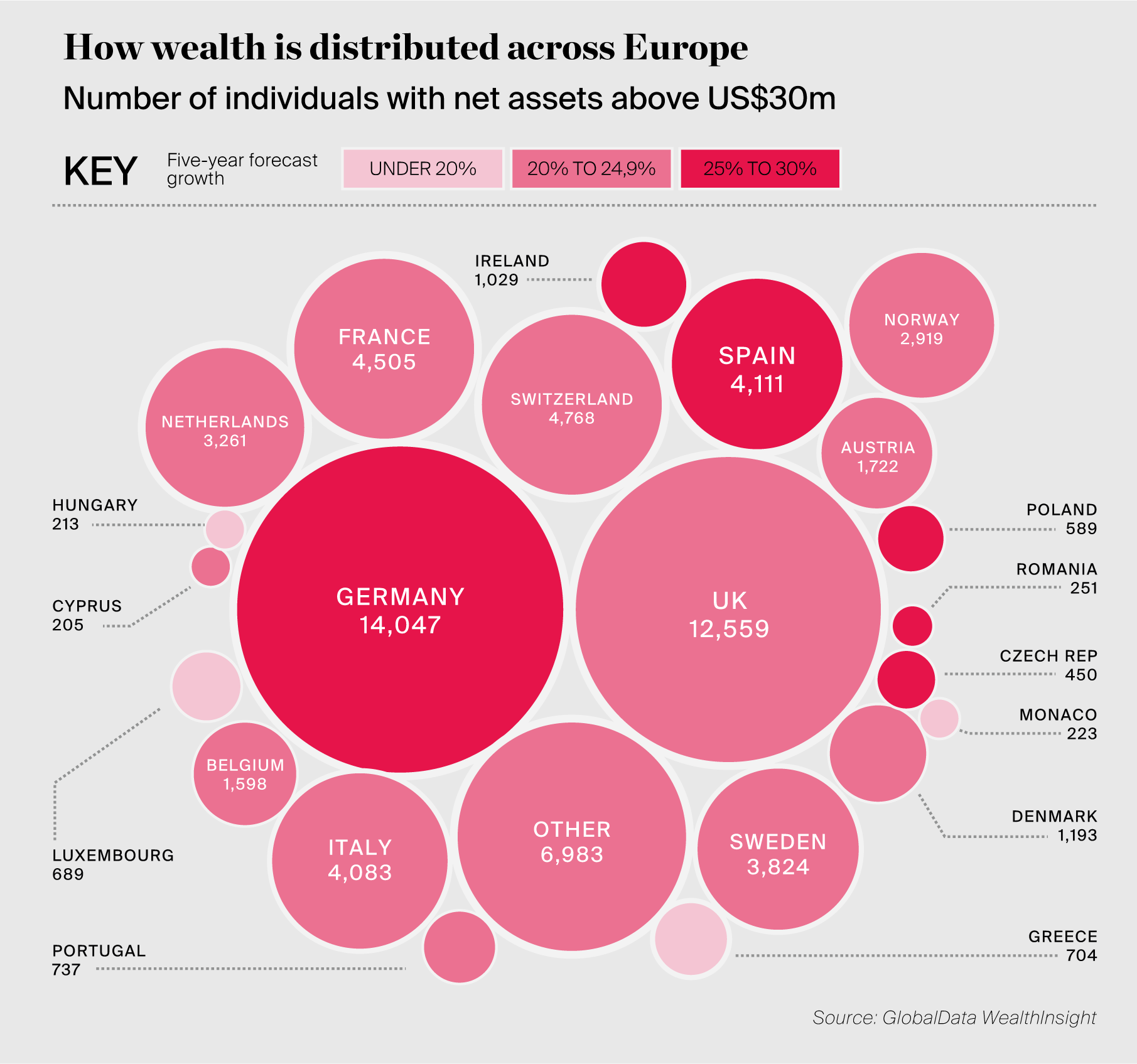

Web Ultra High Net Worth 06 July 2018. A more typical investor who has 200000 will lose 67000. Web According to Knight Franks 2020 Wealth Report1 there are 103335 HNWIs with a net worth of over US30 million in Asia.

Dividend paying whole life insurance is a time tested.

What Is Involved In Financial Planning Quora

Global Population Of High Net Worth Individuals And Their Wealth Hit New Highs

Global Wealth Trends In 2019

High Net Worth Investment Strategies 4 Critical Factors

Home Wealthhub

Hnw Uhnw Life Insurance In Asia Opportunities Challenges For The World Ahead Asian Wealth Management And Asian Private Banking

Why Succession Planning Is Important For Hnw Clients

Wealth Management Private Banking Market Overview Q3 2019 Executive Search Boyden

The Ultra High Net Worth Investor Coming Of Age Kkr

High Net Worth Investment Strategies 4 Critical Factors

What Is Involved In Financial Planning Quora

The Ultra High Net Worth Investor Coming Of Age Kkr

Legacy Succession Planning Tips For High Net Worth Individuals

High Net Worth Investment Strategies 4 Critical Factors

The Ultra High Net Worth Investor Coming Of Age Kkr

How To Successfully Plan Your Legacy

The Art Of Protecting Ultra High Net Worth Portfolios And Estates Strategies For Families Worth 25 Million To 500 Million Ashoo Haitham Hutch E Snyder Christopher G 9781599326559 Amazon Com Books